|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

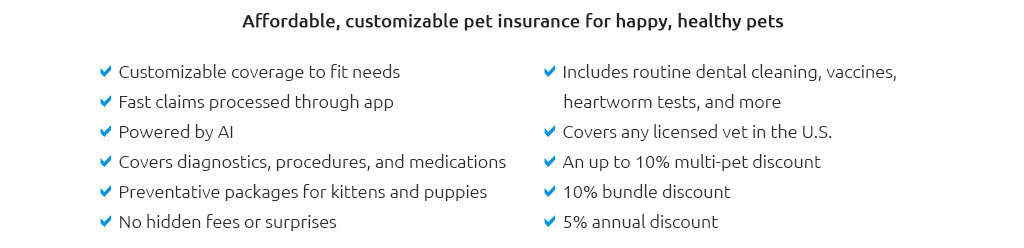

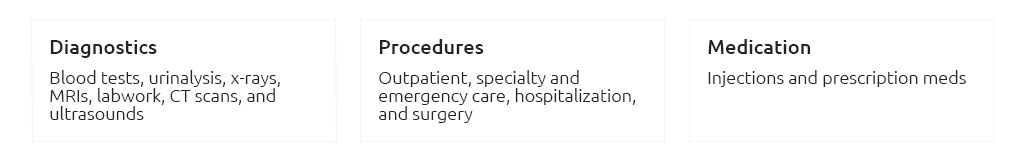

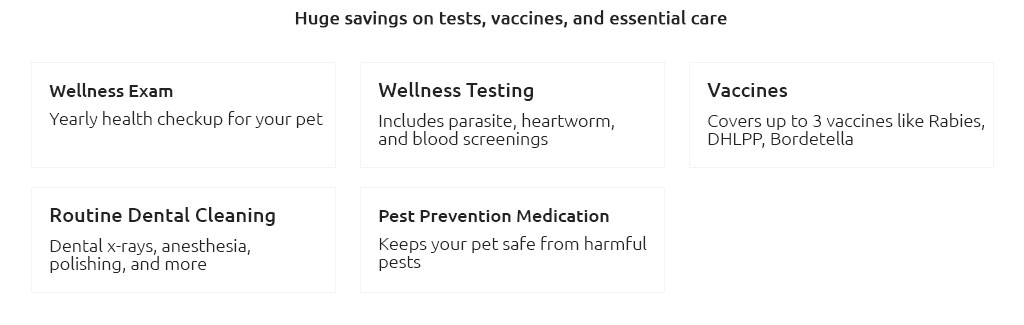

Exploring the Landscape of Cheap Pet Insurance: What to ExpectWhen contemplating the notion of cheap pet insurance, it's essential to traverse the terrain of available options, understanding not only the cost but also the breadth of coverage and value these plans can offer. Pet insurance, once a niche market, has burgeoned into a robust industry, catering to the varied needs of pet owners. As we embark on this exploration, let's delve into the intricate details that define affordable pet insurance, ensuring that cost-effectiveness does not equate to compromise on quality. Initially, it is imperative to grasp the fundamental components that constitute a pet insurance policy. At the core, most plans cover accidents and illnesses, yet the spectrum of coverage can vary significantly, influencing the overall cost. Basic plans typically focus on major medical expenses, often excluding routine care, which is a consideration for those seeking budget-friendly options. Conversely, comprehensive plans might encompass wellness visits, vaccinations, and even dental care, albeit at a higher premium. Therefore, when assessing cheap pet insurance, one must weigh the immediate affordability against potential long-term benefits. Another pivotal aspect is the deductible and reimbursement level. Opting for a higher deductible usually translates to lower monthly premiums, an attractive proposition for pet owners prioritizing lower upfront costs. However, it is crucial to ponder the financial implications in the event of a claim. Reimbursement levels, often ranging from 70% to 90%, also play a significant role in determining the overall expense. A plan with a lower reimbursement percentage might appear economical initially, yet could lead to higher out-of-pocket expenses when veterinary bills arise. In the realm of cheap pet insurance, one cannot overlook the nuances of policy limits. These limits, be they annual, lifetime, or per incident, dictate the maximum payout one can receive. Scrutinizing these limits is vital, as they can profoundly impact the policy's effectiveness in safeguarding against unforeseen medical costs. A policy with a lower premium may have restrictive limits, potentially undermining its utility when faced with significant veterinary expenses. Furthermore, the landscape of pet insurance is not immune to the influence of a pet’s breed, age, and health condition. Insurance providers often calibrate their premiums based on these factors, with some breeds incurring higher costs due to predisposed health issues. It is advisable for prospective policyholders to conduct thorough research, comparing quotes from various insurers, ensuring they secure a plan that aligns with their pet's specific needs.

FAQ SectionWhat is the average cost of cheap pet insurance? The average cost of cheap pet insurance can vary widely, typically ranging from $10 to $30 per month, depending on the level of coverage and the pet's characteristics. Does cheap pet insurance cover pre-existing conditions? Most cheap pet insurance plans do not cover pre-existing conditions, although some insurers may offer limited coverage after a waiting period. Are there any exclusions in affordable pet insurance plans? Yes, affordable pet insurance plans often come with exclusions such as elective procedures, grooming, and certain hereditary conditions. How can I ensure I am choosing the best cheap pet insurance? To choose the best cheap pet insurance, compare multiple providers, review policy details carefully, and consider both the short-term costs and long-term benefits. https://www.usnews.com/insurance/pet-insurance/best-cheap-pet-insurance

Key Takeaways - Lemonade is the cheapest pet insurance company for dogs and cats with sample monthly rates of $26.83 and $14.74, respectively. - The price you pay ... https://www.forbes.com/advisor/pet-insurance/best-cheap-pet-insurance/

What Is the Cheapest Pet Insurance? For affordable dog insurance: Lemonade has cheap dog insurance at $32 monthly on average for $5,000 in ... https://www.embracepetinsurance.com/research/pet-insurance-cost

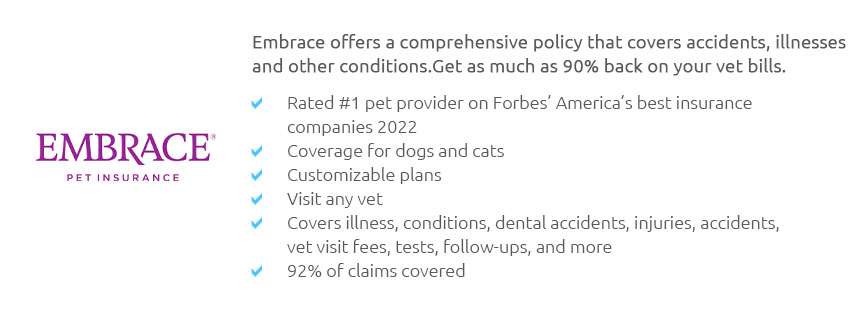

Now let's take a peek at Embrace's rates - for most of our pet parents, it's surprisingly affordable. Most of our dog parents pay between $18 and $72 per month.

|